Everyone wants more of the good stuff on vacation: quality time with friends and family in a great destination, zero stress, and memories that last. Enter the world of timeshares and vacation home ownership models – not all of which are created equal. Shared ownership, fractional ownership, and timeshare models may sound like versions of the same thing until you look under the hood. For affluent families and couples who measure success in both assets and experiences, the fine print makes all the difference.

What are you actually buying into? What’s worth your time, money, and energy? And which model delivers the most long-term value?

What You’re Actually Getting

When weighing shared ownership, fractional ownership, and timeshare options, the biggest difference comes down to what you actually own — and what you don’t.

At the core of it, a timeshare gives you usage rights. You’re paying for a fixed week in a condo or hotel, or in the more “modern” points-based models, you’re collecting tokens to trade in for stays. Either way, it’s not ownership. There’s no deed, no equity, and no asset that holds value over time. Timeshares are notorious for depreciating faster than a car leaving the lot.

Investing in fractional ownership, on the other hand, means a single piece of real estate with your name on it. You co-own an actual slice of property with a limited group of others, deed included. That structure often means longer, more flexible stays, higher-quality homes, and the possibility of value preservation or appreciation. As you don’t own the entire home, only part, your ability to sell your interest is murky.

Then there’s Equity Estates, which pushes the fractional concept further and elevates to owning a shared portfolio of a dozen luxury homes while being able to vacation across 65+ luxury residences. One winter you’re skiing Aspen, and the next you’re sipping wine in Tuscany or sailing in the BVIs. You’re not bound to one spot; you’ve got the world at your fingertips, and, with a defined liquidity path after 10 years, you have an opportunity to realize meaningful returns.

Challenges of Traditional Vacation Home Ownership

Owning vacation properties sounds appealing until you have to deal with the reality of managing property from hundreds or thousands of miles away. The financial and logistical challenges turn dream homes into expensive headaches that consume time and money you’d rather spend enjoying your investment.

These are some of the most common obstacles that vacation homeowners face:

- Unexpected maintenance costs: Experts recommend budgeting 1% of purchase price each year for maintenance, which means that a $500,000 vacation home needs $5,000 per year just for basic upkeep before any major repairs. That doesn’t include emergencies like burst pipes flooding your mountain cabin or a hurricane damaging the roof of your beach vacation home – both scenarios could potentially be covered by insurance, but then those annual costs increase as well.

- Property management difficulty: Professional vacation rental management costs 15% to 40% of monthly revenue; you’re responsible for year-round maintenance, insurance, and upkeep, whether the property generates income or not. Without professional property management, you end up coordinating maintenance, cleaning crews, and other service providers from hundreds or thousands of miles away.

- Location limitations: Buying a luxury vacation home locks you into visiting the same destination over and over again, even when your family’s interests change, or you want to explore new places. Kids who loved the beach house at age 8 might prefer ski trips at 16, but you’re pre-committed to your original choice.

- Seasonal income volatility: Rental income fluctuates massively based on weather and economic conditions beyond your control. A poor snow season could ruin your winter rental income just as a hurricane over Labor Day weekend could cancel your bookings.

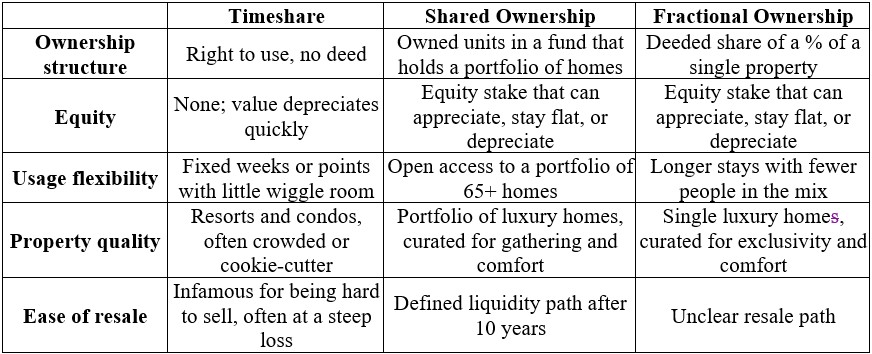

Key Differences Between Shared Ownership, Fractional Ownership, and Timeshares

How does shared ownership and fractional ownership differ from timeshares? From 30,000 feet, they look like three paths to the same promise: All offer a ticket to somewhere beautiful. But the practical differences are sharp, and they determine whether you’re buying a smart lifestyle upgrade wrapped in an investment, or a liability.

How Flexibility Really Works in Each Model

Flexibility is where the wheels come off timeshare models. Traditional timeshares lock you into the same weeks, year after year. Points-based systems promise more freedom, but they come with blackout dates, limited inventory, and the constant scramble to book before everyone else does.

The pros and cons of fractional ownership can be simply explained as a major step up from the perspectives of ease of use and chance at upside. First off, you’re not crammed into a single week. Your group of co-owners can schedule stays that fit different needs and seasons (although if you are one of the last owners to join the fractional home, you may miss the ability to get the best dates). The smaller the ownership group, the more availability there is.

Shared portfolio ownership through Equity Estates multiplies the flexibility that fractional home owners enjoy while making the path to liquidity transparent. Instead of negotiating over one house in Cabo, you’ve got a calendar that opens into 65+ destinations across the globe. Want to switch your fall break from Costa Rica to Hawaii next year? Easy. Dreaming of a last-minute ski trip or a summer villa in Greece? The benefit of a targeted 60% occupancy rate is that you’re not competing with an army of other owners.

Lifestyle, Quality, and Guest Experience

Let’s talk about what the vacation experience itself feels like in the different models.

A timeshare resort might promise ocean views, but you’ll likely be sharing the pool with a hundred strangers. The “luxury” label starts to fade when the front desk hands you a laminated map and a list of housekeeping rules.

Fractional second home ownership lifts the bar. Homes are larger, finishes are higher-end, and service often matches the expectation of discerning owners.

Shared ownership models like Equity Estates makes it seamless. Step into a multi-million-dollar estate and it already feels like yours. The pantry’s stocked with 85+ essentials, the fridge has your favorites, and the beds are turned down. A concierge has tomorrow mapped out, local hosts point you to the gems only insiders know, and daily housekeeping erases any mess before it even starts. All that’s left for you to do is to enjoy making memories.

That’s the lifestyle edge in the ownership vs. timeshare debate: One feels mass-produced, the other feels personal. It’s the difference between renting a vacation house and arriving at your vacation home.

Ownership Models as a Smarter Long-Term Strategy

Nobody buys a timeshare to build wealth. The goal is access, and resale values are so grim that many owners can’t give them away. But there are timeshare alternatives.

Fractional and shared ownership models done right flip that script. With fractional ownership, you hold a deeded interest in real property, meaning your money is tied to something with inherent value. That opens the door for preservation and, in the right markets, appreciation. With shared ownership models, you get equity plus portfolio diversification, which balances risk.

Equity Estates adds more guardrails that are investor-centric: a 10-year defined exit, third-party audits, and a model where the fund manager doesn’t profit until investors do. Rather than a never-ending obligation, you’re buying into a clear plan with transparency built in.

It’s less about chasing returns and more about safeguarding and appreciating your capital while upgrading your lifestyle. You get a smarter place to deploy your liquidity, with beautiful memories with families and friends as your annual dividend.

Not All Ownership Models Are Created Equal (and What To Look For)

Fractional ownership comes in many flavors, and not all of them are designed with owners in mind. Some models overload homes with dozens of co-owners. Others leave management up to the group, which means maintenance calls, HOA-level politics, and endless group emails.

Here’s what to demand if you’re considering this path:

- Limited co-owners per home for better access and availability

- Curated, luxury-grade residences instead of generic condos

- Professional management that handles everything from stocking the fridge to fixing the A/C

- A defined exit strategy so you’re not stuck indefinitely

Why Shared Portfolio Ownership Wins on Long-Term Value

In the end, the choice comes down to whether you simply want to vacation or vacation well.

Luxury home timeshares are designed to be used, not owned. They depreciate, they’re rigid, and they rarely deliver beyond the surface promise. Fractional ownership does better, but most models are tied to a single home.

Portfolio ownership with Equity Estates solves both problems. You’re a co-owner in a diversified collection of luxury estates across the globe. You travel with ease, knowing each property is top-tier and professionally maintained.

If you would like more information about investing with Equity Estates, please reach out to our Investor Relations team at 404.445.8501 or click to schedule a call.